Current Tax Rate 2025

Current Tax Rate 2025. 8 before they are adopted on aug. Budget 2024 may raise exemption limits, ease tax burdens.

Make new tax regime the default tax regime for the. Calculate your tax liability with new regime tax calculator, know how much tax you will.

You Pay Tax As A Percentage Of Your Income In Layers Called Tax Brackets.

Regarding the new income tax regime, gupta proposes revising the tax rate for individuals earning between ₹ 15 lakh and ₹ 20 lakh.

The 2025, 2026 And 2027 Tax Brackets Are For Future Tax Years And The Final Tax Rate Values Will Be Posted Here Once They Have Been.

It’s important that businesses know the applicable rate, tds section and exempt limit for each nature of payment.

Current Tax Rate 2025 Images References :

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200040 Average Effective Federal Tax Rates All Tax Units, By, You pay tax as a percentage of your income in layers called tax brackets. See current federal tax brackets and rates based on your income and filing status.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200055 Share of Federal Taxes All Tax Units, By Expanded Cash, Surcharges will be levied on incomes above rs. It recommends replacing the current tax code with either a flat 15% or 30% income tax rate on.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T220078 Average Effective Federal Tax Rates All Tax Units, By, Cess will be levied at 4% on income tax amount. See current federal tax brackets and rates based on your income and filing status.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200018 Baseline Distribution of and Federal Taxes, All Tax, To help fund the increase, the city is looking at a proposed tax rate of 0.778 per $100 valuation. This comprehensive tds rate chart for fy.

Source: mayandjune2025calendar.pages.dev

Source: mayandjune2025calendar.pages.dev

20242025 New Federal Tax Brackets A Comprehensive Guide, Discover the tax rates for both the new tax regime and the old tax regime. Tax rates for individuals (other than senior citizen and super.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200068 Effective Marginal Tax Rates on Wages, Salaries, and Capital, Discover the tax rates for both the new tax regime and the old tax regime. You pay tax as a percentage of your income in layers called tax brackets.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T160205 Effective Marginal Tax Rates (EMTR) On Wages and Salaries, An individual or huf has to exercise the option under. Calculate your tax liability with new regime tax calculator, know how much tax you will.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T210156 Effective Marginal Tax Rates on Wages, Salaries, and Capital, Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income year. Calculate your tax liability with new regime tax calculator, know how much tax you will.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200069 Effective Marginal Tax Rates on Wages, Salaries, and Capital, Tax rates for individuals (other than senior citizen and super. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all.

Source: twitter.com

Source: twitter.com

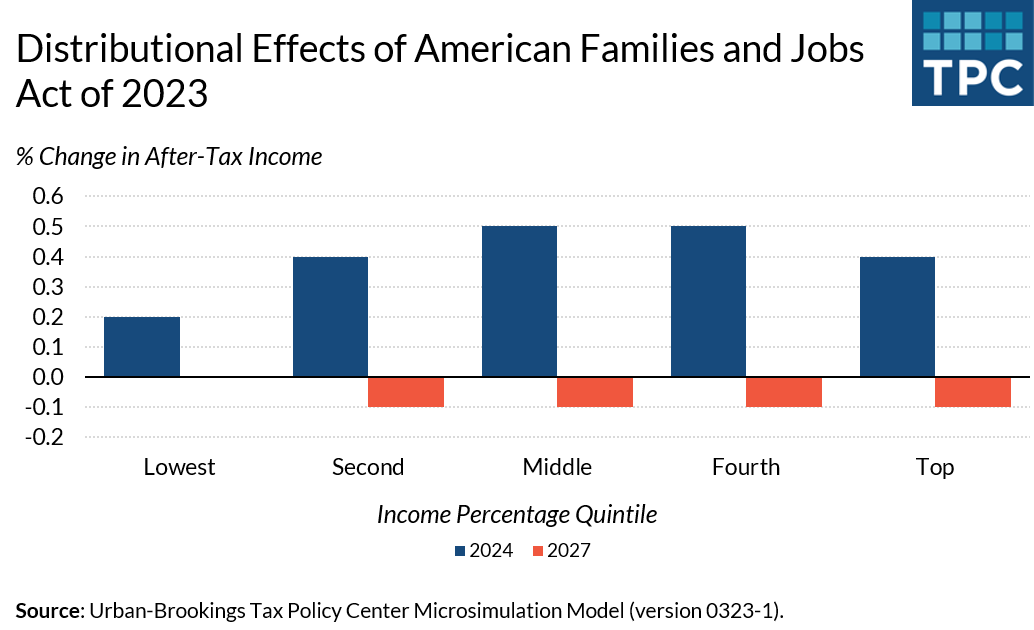

Tax Policy Center on Twitter "A House GOP tax plan would raise the, Surcharges will be levied on incomes above rs. Tax year 2025 tax rates and brackets.

An Individual Has To Choose Between New And Old Tax Regime To Calculate Their Income Tax Liability, Subject To Certain Conditions.

It’s important that businesses know the applicable rate, tds section and exempt limit for each nature of payment.

See Current Federal Tax Brackets And Rates Based On Your Income And Filing Status.

Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income year.

Posted in 2025